Key Factors Affecting Bitumen Prices

Before comparing prices, it is essential to understand the main drivers:

- Crude Oil Prices: As a byproduct of oil refining, bitumen prices are directly tied to fluctuations in global crude benchmarks (especially Brent and WTI).

- Exchange Rates: In import-dependent countries, currency volatility significantly impacts landed bitumen costs.

- Taxes and Tariffs: Some governments impose substantial duties or taxes on bitumen imports or consumption.

- Logistics Costs: Geographic distance, shipping expenses (maritime or rail), and local infrastructure directly affect final pricing.

- Domestic Supply and Demand: Road construction seasons (typically spring and summer) can sharply increase demand and drive prices upward.

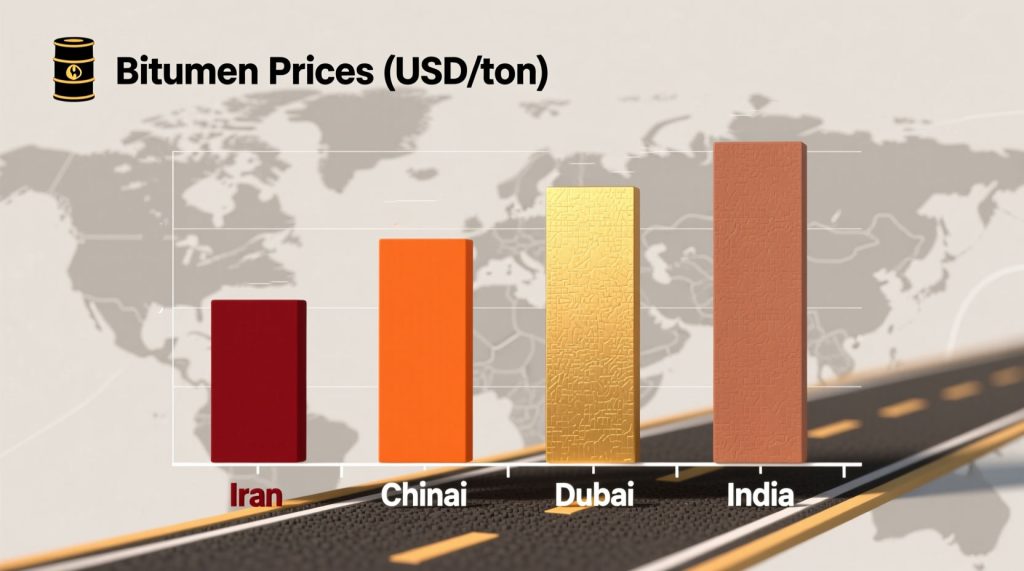

Bitumen Prices in Selected Countries (November 2025)

The prices listed below refer to standard penetration grade 60/70 bitumen, quoted in US dollars per metric ton, based on data from energy firms, commodity exchanges, and industry reports as of mid-November 2025.

1. Iran

- Domestic Price: $250–300/ton

- Key Notes: Iran is among the world’s top bitumen producers, benefiting from low-cost crude feedstock and substantial refining capacity. Consequently, domestic prices remain significantly below global averages. However, international sanctions and banking restrictions can complicate exports.

2. India

- Price: $520–560/ton

- Key Notes: India is the largest global importer of bitumen, driven by massive road infrastructure programs. Despite high demand, the relatively weak Indian rupee and import dependency result in elevated prices.

3. China

- Price: $480–520/ton

- Key Notes: China is both a major producer and consumer. The government occasionally intervenes through subsidies or price controls. Domestic prices fluctuate based on infrastructure spending cycles and refining margins.

4. Saudi Arabia

- Price: $420–460/ton

- Key Notes: As a leading oil and refined products exporter, Saudi Arabia offers competitively priced bitumen, primarily targeting Asian markets. Pricing is closely aligned with Saudi Aramco’s export strategies.

5. United Arab Emirates

- Price: $440–480/ton

- Key Notes: The UAE leverages advanced refining infrastructure and strategic port access to export bitumen competitively to Africa and Asia.

6. Turkey

- Price: $580–620/ton

- Key Notes: Severe lira depreciation and reliance on imported crude have pushed bitumen prices in Turkey well above global averages.

7. United States

- Price: $600–650/ton

- Key Notes: In the U.S., bitumen is commonly referred to as “asphalt binder.” Prices reflect WTI crude benchmarks, state-level fuel taxes, and regional transportation costs.

8. Germany (Representing the EU)

- Price: $560–600/ton

- Key Notes: European bitumen prices are elevated due to stringent environmental regulations, high energy costs, and quality standards.

Global Bitumen Price Trends in 2025

In 2025, global bitumen prices remain relatively high compared to the 2010s, despite a slight post-pandemic demand normalization. This is primarily due to crude oil averaging $75–85/barrel (Brent) and refining capacity constraints in certain regions. Additionally, geopolitical tensions in the Middle East and disruptions in Red Sea shipping routes have increased logistics costs and supply chain volatility.

Conclusion and Outlook

- Oil-producing nations like Iran, Saudi Arabia, and the UAE maintain a strong cost advantage in bitumen production.

- Import-reliant, lower-income economies (e.g., India, Turkey) face greater pricing pressures.

- Long-term demand may gradually decline as alternatives—such as polymer-modified bitumen and recycled asphalt—gain traction in sustainable infrastructure projects.

Ultimately, bitumen pricing reflects not only energy markets but also broader trends in global trade, infrastructure investment, and economic policy. Stakeholders must monitor these dynamics closely to adapt their strategies in an evolving market landscape.

Sources:

- S&P Global Commodity Insights (Platts)

- Argus Media

- Ministry of Petroleum of the Islamic Republic of Iran

- U.S. Energy Information Administration (EIA)

- Shanghai and Bombay commodity exchange market reports

This article was prepared on November 15, 2025.